Income tax in Ireland: a guide

Income tax is a tricky thing to wrap your head around anywhere in the world, let alone in when you move to a new country. You know you have to pay it but how much are you charged? Are there ways to reduce the amount of income tax in Ireland you have to pay? How does income tax work for self-employed people? To help you answer your income tax-based queries, Babylon has assembled this guide to income tax in Ireland! Read more to find out all the information you need.

Income tax

Income tax is a tax levied by the Irish government on income generated through businesses and individuals. In Ireland, taxes are progressive meaning that those who earn more income, pay higher taxes.

There are three main forms of income tax in Ireland: PAYE, USC, and PRSI. Generally, it is your employers responsibility to register your tax information, although if you are self-employed you must register as a chargeable person.

What is PAYE?

PAYE (Pay As You Earn) is a tax deducted from income earned during employment in Ireland by your company on behalf of the government. PAYE is also used for people who receive an occupational pension from a previous employer. The amount of tax you pay depends on the amount of money you earn and your personal circumstances. PAYE is structured so that payments are collected evenly throughout the fiscal year to ensure you do not overpay.

How much you pay is calculated at two rates: the standard rate is 20% of your wages if you earn less than €33,800 per year. If you earn above €33,800 per year, the excess income will be taxed at the higher rate of 40%.

There are a variety of online services that you can avail of via Revenue’s myAccount service. These include viewing your tax record, claiming tax credits, applying for refunds of tax, declaring additional income and more. For a full list of services provided, click here.

What is USC?

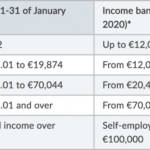

The USC (Universal Social Charge) is a tax you pay if you earn more than €13,000. The percentage of USC you pay is based on all of your income over this limit and is calculated on a weekly or monthly basis. Those aged 70 or over or medical card holders with a total income of €60,000 per year will pay a lower USC rate.

Your employer and/or pension provider are responsible for deducting USC from your salary. For PAYE taxpayers USC is deducted on a cumulative basis, so USC payments are spread out evenly over the fiscal year and the correct amount of USC is deducted at the end of the year. If however, you think you have overpaid USC, you can review your USC and tax on PAYE services through Revenue’s myAccount Service or you can contact your local revenue office.

-

Vehicle-Duties and VRT

-

Value Added Tax

What is PRSI?

PRSI, or Pay Related Social Insurance, is a compulsory tax paid to contribute to the Social Insurance Fund. Your employer is responsible for deducting your PRSI contributions as a part of your PAYE. These payments are used to fund social welfare payments in the form of illness or jobseeker benefits.

Generally, PRSI payments are categorised into different classes depending on the rate of your contribution. Most employees fall into the Class A category, however you can view the full list of classes here. Employers of Class A employees pay 8.8% PRSI on weekly earnings up to €386.

If you earn over €352 per week before tax, you pay 4% PRSI on all of your earnings and your employer pays 11.05% on weekly earnings over €395. If you earn between €352.01 and €424 there are PRSI credits available to you. For more information on these credits, click here and for PRSI class rates, click here.

Tax credits

Tax credits reduce the amount of tax you have to pay by subtracting the credit amount from the amount of tax you have to pay. All taxpayers are entitled to tax credits and there are personal tax credits for single people, those who are married or in a civil partnership, or widowers surviving civil partners. Tax credits are dependent on your personal circumstances. For a full list of tax credits and rates, click here.

Tax reliefs

Tax reliefs reduce the amount of your income you have to pay tax on and may result in a refund of tax that you’ve already paid. The amount of relief you receive is also dependent on your tax rate. If you pay tax at the higher rate of 40%, your income is reduced by the relief and that balance is taxed at 40%. If you pay taxes at the standard rate, your income will be reduced by the relief and that balance is then taxed at 20%. To apply for these refundable tax reliefs, use Revenue’s myAccount.

Taxes for the self-employed and non-PAYE income

If you are self-employed you earn income outside of the PAYE system and therefore a chargeable person. This includes self-employed individuals, those whose main or only source of income is from rental properties, investments, foreign income (including foreign pensions), maintenance payments, and fees that are exempt from PAYE, as well as those who have profited from share options or incentives.

If you are considered to be a chargeable person you must file your own end-of-year tax return. This is handled through the Self-Assessment Tax System which accounts for all income outside of the PAYE system that exceeds €5,000 per year. After registering with Revenue, every year by October 31st, you must pay your preliminary tax (an estimate of income tax, PRSI, and USC for the tax year), file your tax return and self-assessment for the previous year, as well as pay any balance of tax owed from the previous year. Bear in mind, income tax deadlines are different from Capital Gains tax deadlines so double check when each set of paperwork is due to avoid interest charges.

High Income Earner Restriction [HIER]

HIER is a restriction that limits the tax reliefs and exemptions available to the self-employed. You are subject to HIER if:

- your income is greater than or equal to €125,000 (or less if there is income that is normally liable to tax at a specific rate)

- your total tax reliefs are greater than €80,000

- the total of your tax reliefs is greater than 20% of your adjusted income

If any of these sound like you, you will have to include details on your Form 11 filed through Revenue Online Services. You will also be required to file a calculation of the restriction on a Form RR1, accessed through ROS Form 11 Restriction of Reliefs panel.

There are certain tax credits available to self-employed individuals, such as the Earned Income Credit which is not available for passive or investment income and is available at either €1,500 or 20% of your qualifying earned income, whichever is lower.

You guys are so strong, you made it! And now you won’t have to worry quite as much about your taxes. Who knows? Maybe you’re even eligible for a refund, relief or credit! Have advice for anyone new to the Irish tax system? Comment it below!

Featured image: Christian Dubovan